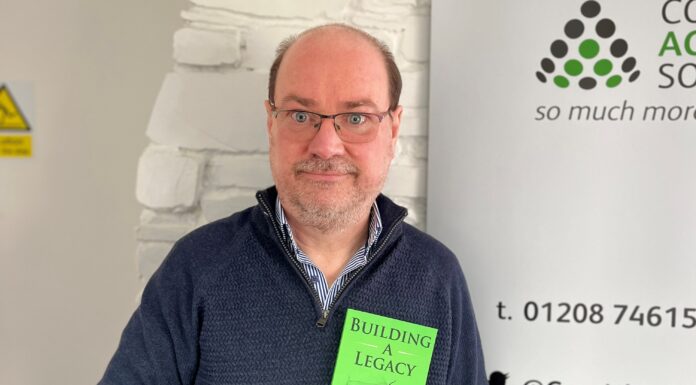

Harland Accountants director Simon Foxhall explains how to make the most of your tax allowances

This time of year is traditionally associated with completing tax returns but businesses should also be looking to make the most from Capital Allowances before the Government reduces Allowance rates in April 2012.

There could be a range of changes in the pipeline but a few will certainly be coming into effect, so businesses must plan now before time runs out.

They are:

- The rate of Writing Down Allowance (WDA) falling from 20% to 18% from 6th April 2012 for plant and machinery

- A cut in the Annual Investment Allowance (AIA) from £100,000 to £25,000 from 6th April 2012

- The rate of WDA for the special rate pool (encompassing integral features, thermal insulation and long life assets) falling from 10% to 8% from 6th April 2012

Firstly the reduction in AIA will impact on most SMEs. The original idea of the AIA was to encourage investment in plant and machinery with immediate cash flow benefits of writing back this expenditure against profits in the year of purchase and in most cases this meant reduced tax payments straight away.

But businesses must think about longer term equipment requirements now because coupled with the reduction in the Writing Down Allowance the overall gain from Capital Allowances will be significantly lower from April 2012.

Therefore some real cash benefits could be brought to your business by discussing this with your accountant or advisor as soon as possible.

Do you have the capital to invest into plant and machinery in the first place? With interest rates at historic lows, which many experts believe will only increase, why not take advantage now and finance equipment purchases?

Utilising finance brings the immediate benefit of tax advantages whilst allowing the cost to be spread over the useful life of the assets. Again, accountants and advisors should be able to assist, even in securing funds for asset purchase.

Well organised businesses should be able to find willing lenders but planning will be vital, like having a formal business plan to give structure, clarity and weight to your business development proposal.

On the personal side with the end of the tax year coming, have you looked to take advantage of annual gift allowance or considered the benefit of inheritance tax allowances in the form of Potentially Exempt Transfers (PETS)?

At the end of the day are you making the most of your Capital Allowance? As we’ve commented before, using the correct advisors can seriously increase your wealth!

This article first appeared in the Dec 2010/Jan 2011 issue of Business Cornwall